A New Wave of IC Price Hikes: The Global Electronics Industry Faces a Major Test

As the global semiconductor supply chain continues to experience turbulence, a powerful and widespread surge in chip prices is sweeping across the electronics industry. From memory devices to passive components and automotive-grade ICs, nearly every critical segment is being affected. Industry consensus is clear: a new cycle of volatility and uncertainty has begun, and building a more resilient supply chain has never been more urgent.

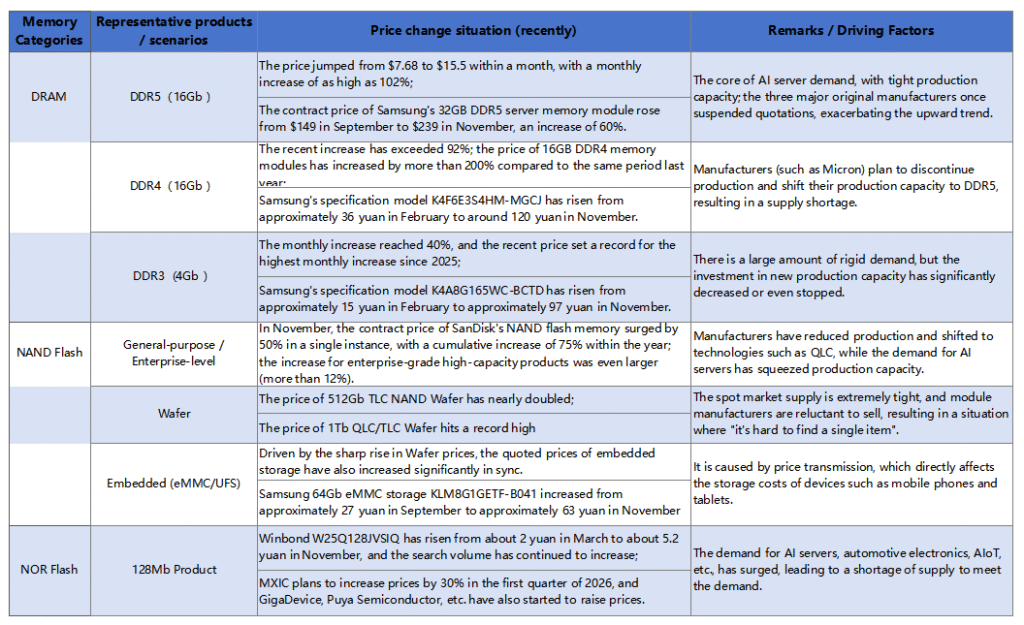

Memory: The Core Driver of Price Increases

AI servers’ massive demand for high-performance memory has reshaped the traditional supply-demand structure. DDR5 has become the focal point of this round of price hikes, with costs far exceeding expectations. DDR4, triggered by end-of-life announcements, has also seen sharp increases, even leading to temporary price inversions with DDR5. Major manufacturers such as Samsung and SK Hynix are expanding DRAM production capacity aggressively, further tightening the market. Meanwhile, NAND and NOR Flash have joined the rally, with SSDs and embedded storage products experiencing significant price surges.

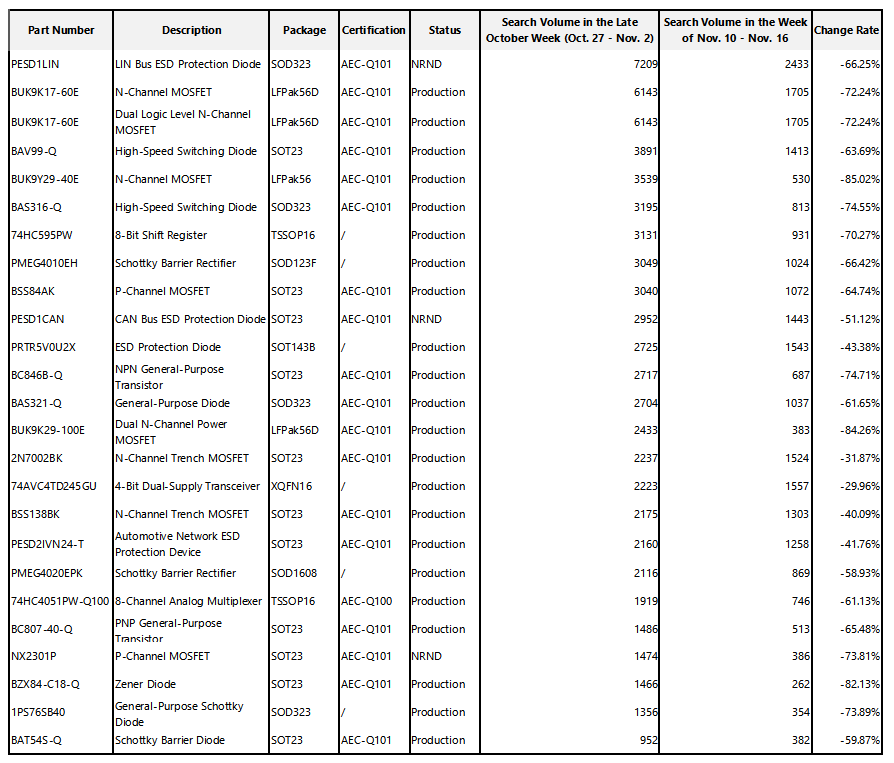

Nexperia: Substitution Strategies Take Shape

Nexperia’s materials saw panic-driven price spikes in late October, but demand has cooled since November. As substitution solutions gradually solidify, companies such as Infineon, onsemi, STMicroelectronics, and domestic suppliers are stepping in to fill the gap, reshaping the automotive-grade IC supply landscape.

Passive Components: Rising Costs Meet Growing Demand

Products including tantalum capacitors, inductors, varistors, and ceramic capacitors have all reported price increases. Rising raw material costs, combined with surging demand from AI servers, automotive electronics, and 5G infrastructure, are pushing the industry into an upward cycle. Leading players like Murata and Samsung Electro-Mechanics remain optimistic about future growth.

Core ICs: Structural Opportunities Emerging

High-end analog and power devices are benefiting from AI-driven demand, while the MCU market shows clear segmentation. Consumer-grade MCUs remain in a destocking cycle, but automotive, edge AI, and industrial applications are becoming the new focus for manufacturers such as STMicroelectronics and NXP.

Outlook

This wave of IC price hikes is broad and interconnected. For example, soaring memory costs may force smartphone makers to reduce production, indirectly impacting demand for other components. The complex interplay of these factors makes future market trends difficult to predict. What is certain, however, is that 2026 will be anything but calm for the semiconductor industry. Companies must plan ahead and strengthen supply chain resilience to withstand this new cycle of challenges.